How to formulate the best-in-class intraday strategies?

Intraday trading is considered one of the most lucrative means of earning profits in the stock market. Investors buy and sell commodities and stocks on the same day to make the best amount of profits with limited investment and time. There are various rules, regulations, and even strategies associated with successful intraday trading that one must be aware of. However, beginners without any experience must understand tips and ways for creating the best-in-class intraday trading strategies. We have listed certain ways that can help traders in the formulation of the best intraday trading strategy. These are as follows:

- Understanding theoretical and fundamental trading concepts:

The creation of a successful intraday trading strategy involves an understanding of various theoretical fundamentals. One must be aware of the workings of stock market aspects that affect price fluctuations and dedicated concepts that can help with successful trading on the stock market. Careful reading, market analysis, and other essential aspects must be understood and analysed for becoming a successful intraday trader and developing a dedicated strategy in the long run.

- Understanding the various markets:

Intraday trading is not limited to stocks and securities. Commodities and even currencies are involved in intraday trading. The pros and cons of trading in different markets must be weighed in before creating a particular strategy. Forex, currencies, stocks, and even futures are involved in intraday trading that one must analyse for successful selection of a market and intraday trading.

Read Also: How To Study Monthly Current Affairs For UPSC Exam?

- Selection of the time for intraday trading:

Apart from the market selection, one must carefully select the proper time for intraday trading as well. Timing the market properly and regularly is essential for the creation of a successful intraday trading strategy in the long run. The best time for buying and selling different commodities, stocks, and securities on a stock exchange must be identified and followed for the creation of a strategy.

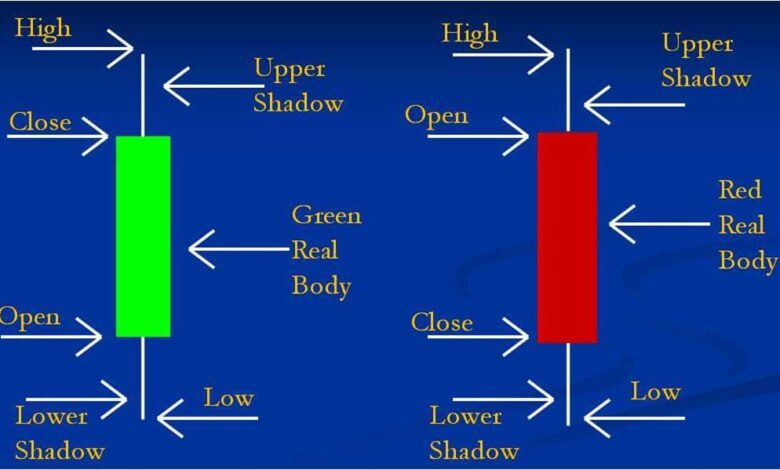

- Understanding of entry and exit points:

Entry and exit points must also be evaluated and understood for the creation of a successful intraday trading strategy. Candlestick’s method of analysing charts can help traders understand the best position at which they must enter or exit a particular position for reducing the chances of losses or for booking maximum profits.

- Opt for virtual trading:

Another great way of developing a successful introduced strategy is to opt for virtual trading. Dedicated companies make available applications that can allow users to trade virtually without any need for actual involvement of money. This can help traders understand the working of a stock market and therefore use their available knowledge for intraday trading. Proper experience can help in the creation of a successful intraday market trading strategy that can be easily tried and tested through virtual trading.

We have listed the best intraday tips that can prove beneficial for intraday traders. The creation of a successful intraday trading strategy involves a proper understanding of various aspects. Experience also counts that can help in the creation of a strategy that is tried and tested by a trader in the long run. Intraday traders can even analyse various intraday trading strategies available and combine the same with their experience and knowledge for better profit-making.